Introduction

STAG Industrial Inc. can be considered a stalwart in the real estate sector, standing out for its specialized focus on single-tenant industrial properties across the United States.

As a Real Estate Investment Trust (REIT), STAG has carved a niche in acquiring and managing warehouses and distribution centers that serve single tenants, a strategy that offers both unique advantages in terms of stability and risk management. This focus is particularly appealing if you are an investor seeking regular income, since STAG distributes monthly dividends that are supported by consistent cash flow generated from long-term leases with industrial tenants.

Purpose of the Article:

This article aims to dive into STAG Industrial Inc.’s operational framework and investment strategy. We will evaluate the REITs business model, scrutinize its dividend performance over recent years, and assess its financial health. Additionally, we will explore STAG’s strategic approach to real estate acquisitions and its power in capitalizing upon the industrial property market. By examining these key areas, we hope to provide you with some comprehensive insights into the advantages and potential risks associated with investing in STAG.

Relevance to Investors:

In today’s investment landscape, there is a growing interest among investors in real estate investment trusts (REITs), due to their potential to offer stable rental income and attractive yield opportunities. All of this is possible, without actually managing the property yourself, and instead leaving it up to the REITs operations team.

STAG Industrial stands out in terms of REITs, due to its strategic focus on industrial real estate, which has been traditionally a market segment which has shown resilience and growth, even in challenging economic conditions. The company’s strategy of diversifying across various geographic markets and focusing upon industrial properties positions it well to capitalize on the increasing demand for distribution centers driven by e-commerce growth. For investors, STAG represents an opportunity to engage with a REIT that combines both reliability in income generation, along with strategic growth through targeted acquisitions.

Section 1: STAG’s Business and Dividend Profile

Overview of Operations

Business Model:

STAG Industrial Inc. employs a focused operational strategy centered on acquiring and managing single-tenant industrial properties, primarily warehouses and distribution centers that cater to individual tenants. This business model is particularly strategic as it taps into the growing demand for industrial spaces driven by e-commerce and manufacturing growth. By leasing properties to single tenants, STAG ensures a streamlined management process and typically longer lease agreements, which contribute to stable and predictable revenue streams.

Geographic and Property Diversification:

STAG’s portfolio is not only vast but also strategically diversified across key industrial hubs in the United States. This geographic spread is critical in mitigating risks associated with regional economic downturns and capitalizing on emerging market opportunities. The types of properties managed by STAG, ranging from light manufacturing facilities to bulk warehouses, are chosen for their strategic locations near major transportation nodes. This positioning enhances the properties’ value due to the ease of distribution it offers to tenants, thereby supporting both occupancy rates and rental yields.

Dividend Analysis

Dividend History and Growth:

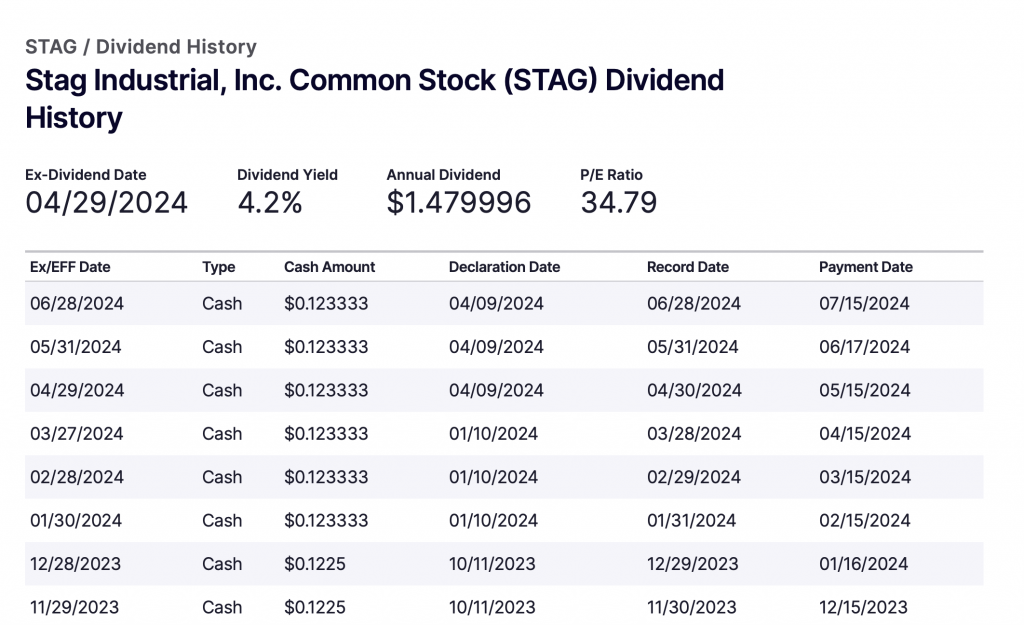

STAG Industrial has established a strong track record of stable and growing dividends over the last 10+ years, reflecting its solid operational performance and commitment to returning value to shareholders. Historical data on dividend payouts shows a trend of consistent growth in the dividend amounts over the years, even if it is only by a gradual amount.

This trend is a testament to the company’s financial health, along with its ability to generate reliable cash flows from its real estate portfolio. Take a look at a screen shot of STAG’s most recent dividend payouts, with a current dividend amount paid every month of $0.123333:

Dividend Yield and Frequency:

- Dividend Yield: STAG’s current dividend of 4.2% yield is competitive within the REIT sector, making it an attractive option if you are an income-focused investor. The yield is supported by the company’s strong occupancy rates and efficient property management, ensuring that income generation is both steady and sustainable.

- Monthly Dividends: Unlike many REITs that distribute dividends quarterly, STAG offers the ability to earn monthly dividends. This frequent distribution schedule is particularly advantageous if you are an investor who relies on regular income to meet monthly expenses, or reinvest earnings more quickly. Monthly dividends also illustrate STAG’s confidence in its ongoing cash flow and financial stability.

Conclusion of Section 1

STAG Industrial Inc.’s business model of focusing on single-tenant industrial properties, along with its strategic geographic and property diversification, positions the company well within the industrial real estate market. The REIT’s consistent dividend growth and the unique offering of monthly payouts further enhance its appeal if you are an investor who is seeking regular, reliable income streams.

This solid dividend profile, backed by a strong operational strategy, underscores STAG’s potential as a stable investment in the rapidly evolving real estate landscape. In the following sections, we will discuss STAG’s financial health (including recent earnings), strategic acquisitions, and future outlook to provide a comprehensive view of its investment potential.

Section 2: Financial Performance and Health

Key Financial Metrics

Revenue Streams:

STAG Industrial’s financial foundation is solidly built on its revenue from rental income, which is directly tied to its high occupancy rates and the strategic acquisition of new properties, including the purchase of one building in the first quarter of 2024, consisting of 697,500 square feet. The company’s operational strategy ensures that it not only retains a high occupancy rate, but additionally invests properties that contribute positively to its growth over the long-term.

- Rental Income: The primary source of STAG’s revenue, rental income based upon the warehouse, industrial, and e-commerce sectors, is stable due to the specific niche STAG is targeting, along with long-term leases & tenants who often bear the costs of taxes, maintenance, and insurance, thus reducing variability in net income.

- Occupancy Rates: Currently, STAG has an occupancy rate of 97.7% on the total portfolio and 97.9% on the Operating Portfolio, as of March 31, 2024. During COVID-19, STAG additionally had a very high occupancy rate & held up very well.

- Impact of New Acquisitions: Each new acquisition is strategically chosen to complement the existing portfolio, enhance geographic diversity, and support higher overall occupancy rates, which in turn helps to drive revenue growth. As mentioned, STAG acquired one property in the first quarter of 2024.

Profitability and Cash Flow:

- Net Income Trends: Analyzing trends in STAG’s net income helps gauge its profitability over time. Despite the cyclical nature of real estate markets, STAG has managed to maintain a steady increase in net income, reflecting efficient property and financial management. For the first quarter of 2024, STAG reported $0.20 of net income per basic and diluted common share, which is consistent with previous net income results.

- Cash Flow Statements: The cash flow from operations provides insight into the company’s ability to generate sufficient cash to cover its expenses and dividend payments. Consistently positive operational cash flows are a good indicator of the company’s healthy financial operations and its ability to sustain dividend payouts. The good news is, STAG has produced net operating income (NOI) of $145.5 million for the first quarter of 2024, which represents an increase of 9.7% compared to the first quarter of 2023, when it came in at $132.6 million.

Financial Stability

Debt and Leverage:

- Use of Debt: STAG utilizes debt as part of its capital structure to finance property acquisitions and other investments. However, the company’s use of debt is carefully managed to maintain a balance between leveraging opportunities for growth and ensuring financial safety. For example, STAG originated $450 million of fixed rate senior unsecured notes in a private placement offering recently, and was able to refinance $200 million of a loan to a further maturity date in 2027. All of these actions ensure that STAG will maintain adequate liquidity and are strategic moves for the company’s balance sheet.

- Capital Structure: The composition of STAG’s capital structure, including the proportion of debt versus equity, is strategically managed to optimize the cost of capital while maintaining flexibility in terms of its operations.

Interest Coverage and Liquidity Ratios:

- Interest Coverage Ratio: This metric is essential, since it indicates STAG’s ability to meet its interest obligations from its earnings. A strong interest coverage ratio suggests that the company may be well-positioned to handle its debt, even in less favorable economic conditions.

- Liquidity Ratios: STAG’s liquidity ratios, such as the current ratio and quick ratio, are important to assess its ability to meet short-term liabilities. High liquidity ratios indicate that STAG can easily cover its immediate obligations, which is essential for sustaining operations and confidence among investors.

Conclusion of Section 2

STAG Industrial’s significant financial health is evident from both its stable revenue streams, sound profitability, and strong cash flow metrics. The company’s strategic use of debt, and effective management of its capital structure further confirms its financial stability, ensuring it remains resilient even in fluctuating market conditions.

STAG’s ability to cover interest expenses and maintain high liquidity supports its ongoing operations and continuous dividend payments, making it a potentially attractive option if you are an investor who is seeking a reliable, income-generating asset. The next sections will explore STAG’s strategic real estate acquisitions and provide a forward-looking analysis of its market potential and challenges.

Section 3: Market Position and Strategic Moves

Competitive Edge

Niche Market Focus:

STAG Industrial has strategically positioned itself within the niche of single-tenant industrial properties. This focus provides several advantages:

- Stability and Predictability: Single-tenant properties often involve long-term leases, which provide stable and predictable revenue streams. This setup minimizes vacancy risks and simplifies property management.

- Risks: However, this strategy also comes with potential risks, primarily the dependency on the financial health of individual tenants. Economic downturns affecting key tenants could significantly impact STAG’s revenue.

Occupancy Rates and Tenant Relationships:

- High Occupancy Rates: As discussed earlier, STAG boasts consistently high occupancy rates, a testament to the effectiveness of its property management and tenant selection processes. High occupancy rates are no doubt essential for maintaining steady cash flow from rental incomes.

- Tenant Relationships: The company places a strong emphasis on fostering positive, long-term relationships with its tenants. These relationships are crucial for retaining tenants and negotiating favorable lease terms, which in turn helps to support consistent rental income.

Growth Strategy

Acquisitions and Expansions:

- Recent and Planned Acquisitions: STAG continues to expand its portfolio through strategic acquisitions that complement its existing properties and bolster its presence in key industrial markets. Each acquisition is carefully evaluated to ensure it meets specific criteria related to location, tenant creditworthiness, and potential for appreciation.

- Impact on Market Presence and Revenue Growth: By strategically increasing its property holdings, STAG not only enhances its market presence but also diversifies its revenue sources, reducing the impact of potential downturns in any single market or sector.

Conclusion of Section 3

STAG Industrial’s focused approach on single-tenant industrial properties has solidified its competitive edge in the real estate market. The company’s high occupancy rates and strong tenant relationships contribute to its financial stability, while strategic acquisitions and a commitment to innovation and sustainability drive its growth and adaptability.

Through these strategic moves, STAG not only enhances its market position but also secures its future growth trajectory, making it a compelling entity in the industrial real estate sector. The next sections will further explore the implications of these strategies on STAG’s long-term market potential and the broader industry context.

Section 4: Risks and Opportunities

Potential Risks

Market Volatility and Economic Impact:

The industrial real estate sector, like any other, is susceptible to economic cycles. Factors such as economic downturns can significantly influence the demand for industrial properties:

- Impact on Demand: In times of economic recession, the demand for warehouse and distribution center space might decline, as companies reduce inventory levels and scale back operations. This could impact both occupancy rates and rental income for STAG.

- STAG’s Positioning: Despite potential market fluctuations, STAG is well-positioned to handle these challenges due to its diversified portfolio and strategic focus on high-demand regions. Additionally, the long-term nature of its leases provides a buffer against short-term market volatility.

Regulatory Changes:

Changes in real estate regulations or taxation can impact STAG’s operations:

- Operational Efficiency and Profitability: New regulations or changes in property taxes could increase operational costs or affect STAG’s profitability margins. For instance, changes in zoning laws or environmental regulations could impose additional compliance costs.

- Strategic Response: STAG’s proactive approach to regulatory compliance and its ongoing efforts to engage with policymakers help mitigate potential negative impacts from regulatory changes.

Investment Opportunities

Sector Trends:

Several trends present growth opportunities for STAG within the industrial real estate sector:

- Growth of E-commerce: The continuous expansion of e-commerce is a significant driver for the demand for distribution centers and warehouses, sectors where STAG holds considerable expertise and assets. This trend is expected to persist as consumer preferences shift increasingly towards online shopping.

- Technological Advancements: Innovations in logistics and supply chain management, such as automation and advanced inventory systems, also create opportunities for STAG to enhance the functionality and attractiveness of its properties.

Strategic Developments:

STAG can further capitalize on these trends through strategic developments:

- Ventures into New Regions: Exploring opportunities in emerging markets or regions experiencing rapid growth due to technological or economic developments could open new avenues for expansion.

- Diversification into New Sectors: While STAG primarily focuses on single-tenant industrial properties, diversifying into related sectors such as multi-tenant logistics hubs or specialized cold storage facilities could tap into new customer bases and increase revenue streams.

Conclusion of Section 4

STAG Industrial faces a mix of both risks and opportunities that are characteristic of the rapidly changing industrial real estate market. Economic fluctuations and regulatory changes pose potential risks, but the ongoing growth of e-commerce and strategic expansion opportunities offer paths for substantial growth.

By maintaining a proper risk management strategy and leveraging sector trends, STAG is well-equipped to enhance its market position and capitalize on emerging opportunities. This balanced approach would not only mitigate risks for the company, but also position STAG to take full advantage of the evolving industrial real estate landscape.

Section 5: Investment Potential

Valuation and Investor Returns

Stock Valuation:

STAG Industrial’s stock valuation provides critical insights into its attractiveness as an investment option relative to its peers in the industrial real estate sector:

- P/E Ratio: The Price to Earnings (P/E) ratio is a fundamental metric used to determine if a stock is undervalued or overvalued compared to the industry average. STAG’s P/E ratio, when compared with the industry, can indicate how the market values its earnings growth prospects.

- FFO (Funds from Operations): For REITs like STAG, FFO is a more accurate measure of operational performance than traditional earnings metrics. FFO adds both depreciation and amortization back into the earnings picture, subtracting gains on sales and providing a clearer picture of the company’s profitability from its core operations. Comparing STAG’s FFO per share with industry averages can help to assess both its operational efficiency and financial health.

- Comparison with Industry Averages: Analyzing these metrics in relation to industry averages can allow you to gauge STAG’s market standing. A favorable comparison might suggest that STAG is a potentially undervalued investment opportunity, offering the potential for decent long-term returns at a reasonable price.

Risk/Reward Profile:

Investing in STAG involves weighing its potential risks against the possible rewards:

- Dividend Returns: One of the primary attractions of investing in STAG is its consistent and competitive dividend payouts, which provide a regular income stream for investors. The appeal of these dividends is particularly strong in a lower interest-rate environment, where alternative fixed-income options may offer lower yields. Thus, if the Fed ever does cut rates like originally anticipated at the beginning of 2024, then STAG may benefit from such a move.

- Operational and Market Risks: While STAG’s dividends are attractive, you should also consider the operational risks related to its focus on single-tenant properties, which could be impacted by tenant defaults or economic downturns. Additionally, market risks, including fluctuations in the real estate market and regulatory changes, could affect property values and rental income.

- Balancing Risk and Reward: The decision to invest in STAG should be based upon your risk tolerance, investment goals & time horizon. If you are prioritizing income generation and are comfortable with the inherent risks of the real estate sector, STAG presents a compelling investment opportunity. Conversely, investors with a lower risk tolerance might find the potential operational and market risks a significant concern.

Conclusion of Section 5

Evaluating STAG Industrial’s investment potential involves a comprehensive analysis of its valuation metrics, along with its potential risk/reward profile.

The company’s competitive, long-term dividend payouts on a monthly basis, along with its solid financial fundamentals, as evidenced by its FFO and comparative valuation metrics, underscores its attractiveness as an investment. However, you should carefully consider the operational and market risks associated with its business model, along with the broader industrial real estate market in terms of your own portfolio.

If you are looking for regular, monthly dividend income and are comfortable with the sector-specific risks, you may find STAG appealing. However, if you are perhaps seeking investments with lower volatility, you may weight STAG against a benchmark index such as the S&P 500, to determine if it is worth your own risk-reward profile when it comes to choosing investments.

Ultimately, STAG’s blend of both steady income, along with the potential in terms of its strategic market positioning makes it a potential candidate for inclusion in a diversified investment portfolio, particularly if you may be focused on real estate and higher-yield opportunities.

Conclusion

Summary of Insights

Throughout this comprehensive analysis, we’ve explored various facets of STAG Industrial Inc., a standout entity within the industrial real estate sector known for its specialization in single-tenant properties. Key insights from our examination reveal:

- Consistent Dividends: STAG’s ability to deliver reliable and regular monthly dividends is a core strength, appealing particularly to income-focused investors. This dividend reliability is underpinned by long-term leases and high occupancy rates, which ensure steady rental income streams.

- Effective Property Management: STAG demonstrates a conservative management approach of its industrial properties, with a strategic focus on both geographic and property diversification. This not only helps to mitigate the potential risk associated with economic fluctuations in any single region, but additionally could position STAG to capitalize upon growth opportunities across diverse markets.

- Financial Health: The financial analysis highlights STAG’s sound operational performance, evidenced by strong Funds from Operations (FFO) and a prudent use of leverage, which supports its financial stability and capacity for sustained growth.

Final Thoughts

Looking ahead, STAG Industrial is well-positioned to continue its trajectory of growth and profitability, driven by its focused business model and strategic market initiatives. Key factors that will influence STAG’s future outlook include:

- Strategic Acquisitions: Ongoing and planned property acquisitions are set to expand STAG’s portfolio and reinforce its market presence, particularly in high-demand industrial hubs. These acquisitions, when strategically aligned with market trends, such as the surge in e-commerce demand, are expected to drive further revenue growth.

- Market Positioning: STAG’s niche focus on single-tenant industrial properties positions it uniquely in the real estate market, where demand for distribution and warehouse spaces continues to rise. This specialization, coupled with high operational efficiency, gives STAG a competitive edge over broader-market players.

- Financial Robustness: With a solid financial foundation, STAG is equipped to navigate potential market volatilities and capitalize on investment opportunities. Its disciplined approach to financial management and strategic investments in technology and sustainability will likely enhance its appeal to a broader investor base over the long-term.

In conclusion, STAG Industrial represents a promising investment opportunity for those looking to benefit from the robust industrial real estate sector. Its commitment to delivering shareholder value through consistent dividends, combined with strategic growth initiatives, makes STAG a compelling choice for investors seeking stability and growth in their portfolios. As with any investment, potential investors should consider their individual financial goals and risk tolerance in light of the detailed insights provided.