Overview of JEPQ ETF

In terms of portfolio income solutions, the J.P. Morgan Equity Premium Income ETF (JEPQ) stands out as a compelling solution that is focused on the growth potential of NASDAQ-100 companies, with a strategic income-generation focus, by selling covered calls.

Launched in May of 2022, by J.P. Morgan Asset Management, this ETF is designed not only to track the NASDAQ-100 Index, but additionally to enhance return potential through a disciplined, option-based income strategy.

JEPQ stands out by focusing on a covered call strategy, which involves holding a portfolio of stocks while additionally selling call options on the same positions. This approach aims to generate income from the premiums received for the options, a method which is advantageous in markets experiencing low volatility or slight declines. The ETF’s primary goal is to offer a mix of appreciation potential from the tech heavy NASDAQ-100 index, along with stability through an options based cash flow approach.

Relevance & Timing

The launch and ongoing market trends and JEPQ are timely, since JEPQ addresses several market dynamics which have been popularized with many investors. Below are a couple of factors that stand out in terms of why JEPQ may be a beneficial solution for investors:

- Increased Market Volatility: In recent years, especially throughout various global crises and economic uncertainties, markets have experienced heightened volatility. In such environments, the income generated from selling call options can provide a steady cash flow buffer, making investments such as JEPQ particularly appealing.

- Economic Recovery Phases: As economies shift between, slowdown, recovery, growth and the overall business cycle, the NASDAQ-100’s growth-oriented stocks, predominantly from technology and the consumer services sectors, offer significant growth potential. JEPQ’s strategy allows you to participate in this growth, while potentially mitigating downside risks through the premium income received, which is paid out on a monthly basis.

By incorporating an approach which maintains exposure to the NASDAQ-100 while additionally participating in investments in equity-linked notes (which provide exposure of the U.S. stock market and the covered call approach in this strategy), JEPQ provides an innovative solution if you’re an investor who is seeking to capitalize on both the performance of technology and innovation-led companies, while also seeking to enhance your income in a controlled risk environment, led by experienced fund managers.

This ETF can therefore be beneficial if you’re an investor who wants to potentially grow your portfolio(s), while also aligning with a more conservative, lower volatility & beta approach, for regular income distributions.

As we dive deeper into the specific mechanisms and performance of the JEPQ ETF, it becomes clear how this financial instrument has been tailored to meet both dual objectives of growth and income.

Section 1: ETF Fundamentals

Fund Overview

As we discussed briefly above, the J.P. Morgan Equity Premium Income ETF (JEPQ) represents a strategic approach tailored for both growth & income, and caters to investors looking for not just capital appreciation and participation in the tech heavy NASDAQ index, but additionally a regular income stream. Here are some of the basic details of the fund:

- Ticker: JEPQ

- Inception Date: May 3, 2022

- Issuer: J.P. Morgan Asset Management

This ETF is structured to provide investors with exposure to some of the most dynamic sectors through the NASDAQ-100 Index, and is coupled with an income strategy that is focused on delivering regular income.

Investment Strategy Detailed

Primary Objective and Underlying Index:

JEPQ’s primary investment objective is to generate monthly income, while providing a total return that closely corresponds to that of the NASDAQ-100 Index. The NASDAQ-100 includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization and features companies across major industry groups such as technology, telecommunications, retail/wholesale trade, and biotechnology.

Mechanism of Covered Call Strategy to Generate Income:

- Covered Call Overview: The ETF invests in equity linked notes, which allows it to participate in a covered call strategy, which involves holding a portfolio of the stocks that make up the NASDAQ-100 Index, and simultaneously writing (or selling) call options on those same positions.

- Income Generation from Premiums: These call options are typically sold at or out of the money, which provides the fund with the premium charged to the buyer of the option. This premium is essentially income that is then passed on to the shareholders in the form of dividends.

- Risk Management: This strategy not only helps in generating income, but additionally provides some degree of hedge against the downside risk of the equity exposure, since income received from option premiums can offset some of the potential losses in stock values.

Monthly Distribution of Dividends:

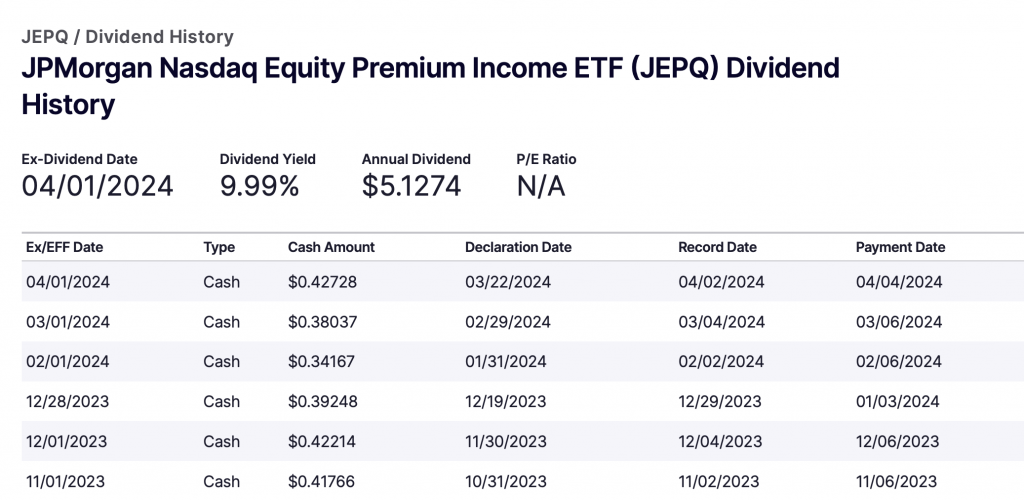

- Dividend Frequency and Yield: As mentioned, JEPQ is focused on distributing dividends on a monthly basis. The yield is derived from the option premiums collected from the covered call strategy, which can vary based on volatility and other market conditions. This approach seeks to offer investors a higher yield potential relative to many other equity strategies, which can be particularly appealing in the current lower interest rate environment. Below, you will see a snapshot of some of the most recent dividend payments for JEPQ, courtesy of Nasdaq.com:

The covered call strategy which JEPQ employs is designed to provide you with a mix of potential upside from one of the world’s leading stock indices, while additionally mitigating risk and generating consistent income. This makes JEPQ an attractive option if you’re an investor who needs regular income from your portfolio(s), but are additionally looking for growth opportunities without taking on excessive risk.

FYI: One consideration when it comes to risk, for example, is that JEPQ’s beta is .85, which means it is less volatile than the overall S&P 500, represented as a broad market index. This means that although JEPQ participates in some of the upside of the Nasdaq index, it still maintains less overall volatility than the benchmark S&P 500. Thus, JEPQ would be expected to achieve less volatility, while still participating in some of the upside the NASDAQ-100. Additionally, JEPQ would be expected to be less volatile in downtrending markets, outperforming the stocks which make up the index.

As we will explore in the subsequent sections, this strategy, while conservative, still requires an important understanding of both the opportunities it presents, and the specific challenges it faces.

Section 2: Performance Metrics

Dividend Analysis

Historical Dividend Yields and Payout Frequencies:

As we’ve discussed thus far, the J.P. Morgan Equity Premium Income ETF (JEPQ) is designed to distribute dividends derived primarily from the premiums collected on the covered calls written against the NASDAQ-100 index holdings. Since its inception:

- Dividend Yield: JEPQ has targeted and maintained a relatively high dividend yield, which as of the most recent dividends and courtesy of Nasdaq.com, stands at approximately 9.99% annually. This yield is notably higher than the average dividend yield of other equity income ETFs, reflecting its effective income-generating strategy.

- Payout Frequency: The ETF pays dividends monthly, which is an attractive feature for income-focused investors, providing them regular income streams as opposed to the quarterly distributions that are more common among equity ETFs.

Comparison with Typical Dividend Yields in the Sector:

- JEPQ’s dividend yield is competitive when compared to other income-focused ETFs, particularly those that also employ a covered call strategy. For instance, JEPQ’s cousin, JEPI, is currently yielding, 7.41%, while the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) is currently yielding 6.06%. While yield is not everything, it is a consideration for some income focused investors, who are concerned about the immediate cash flows and income they will receive upon purchasing the fund.

Price Performance

Discussion of Historical Price Fluctuations:

- Since its launch in May of 2022, JEPQ has been relatively flat in terms of its overall share price. Beginning at $50 per share at inception, the current price of JEPQ is $51.98, representing a 5.63% total return in terms of its share price (of course, not including dividends). Below, you will see a graph of the JEPQ ETF since inception, which gives us an idea of how much upside one is really benefiting from in terms of this ETF, especially compared to the Nasdaq 100 index (below).

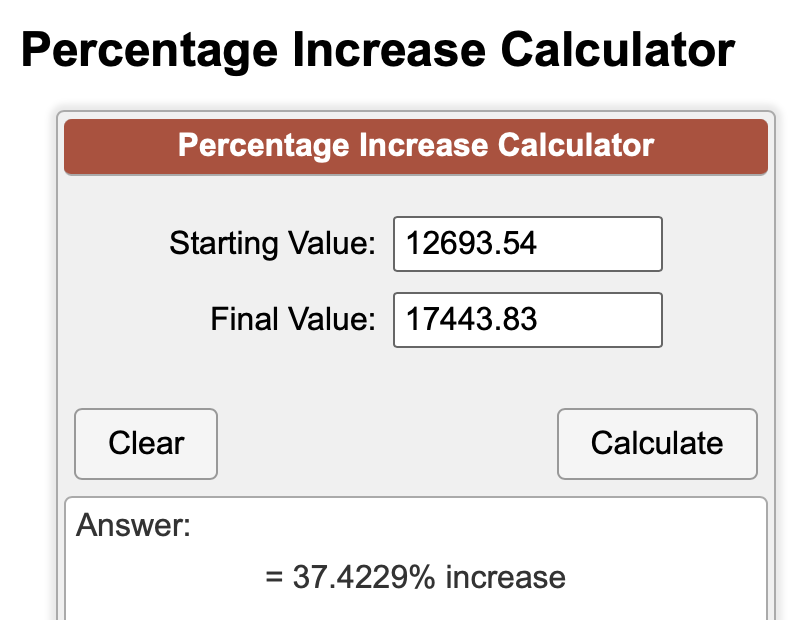

- Below, you will see a picture of the NASDAQ-100 index in relation to the JEPQ ETF, and below that picture, you will see a calculator, which shows how much the index has returned vs JEPQ. While the JEPQ ETF is up 5.63% since inception, the index itself is up 37.42%, representing a difference of 31.79% (as of writing on April 23, 2024).

- This clearly illustrates the significant tradeoff one can experience with an ETF like JEPQ. Although some of the upside has been captured over this time period, some investors may be not be satisfied with the capital appreciation and how much upside JEPQ has achieved thus far.

Impact of Market Conditions on ETF Pricing and Performance:

- Bull Markets: As can be seen from the return comparison above, in strong market uptrends, particularly in the tech sector, JEPQ’s performance in terms of price appreciation may lag behind the NASDAQ-100 due to the “capping” effect of the covered call strategy. The calls written cap the growth potential, since shares might be called away if the stock price surpasses the strike price of the call options, thus leading to less upside potential.

- Bear Markets: In downturns, the premium income generated from the covered calls can help offset the price declines, providing a cushion that can lead to better relative performance compared to the index itself. Thus, it would be expected that the ETF does not participate in as much of the downside movements of the NASDAQ-100 index itself.

Expense Ratio

Comparison of JEPQ’s Expense Ratio to Industry Standards:

- Expense Ratio: JEPQ charges an annual expense ratio of 0.35%, which is relatively moderate and competitive within the category of covered call ETFs. This rate is lower than many actively managed funds, and slightly above the average for passive index funds.

- Industry Comparison: Some equity income ETFs that utilize options strategies such as covered calls may have expense ratios ranging from 0.60% to 1.00%. For example, another ETF which has been popularized in recent years is the Global X NASDAQ 100 Covered Call ETF (QYLD), which has an expense ratio of .61%. JEPQ’s lower expense ratio, therefore, enhances its appeal as it reduces the cost drag on returns.

Analysis of How Costs Impact Investor Returns:

- Cost Efficiency: The moderate expense ratio of JEPQ ensures that a significant portion of the income generated from option premiums is passed on to investors, instead of being consumed by management fees.

- Net Returns: You should take net returns into consideration, which accounts for the expense ratio in addition to the gross income from dividends. JEPQ’s strategy, coupled with its competitive expense ratio, aims to maximize these net returns, especially in comparison to direct investments in the NASDAQ-100 without a covered call strategy.

In summary, JEPQ offers a potential solution if you’re an investors looking to derive income from their equity investments while also participating in the potential growth of NASDAQ-100 companies. The ETF’s strategic use of covered calls enhances income through premiums, which, when combined with a competitive expense ratio, offers a balanced risk-reward profile that can be attractive in various market conditions.

As we further discuss JEPQ’s risk management and strategic advantages in subsequent sections, we hope that you will gain a clearer understanding of how this ETF can potentially fit into a diversified investment portfolio.

Section 3: Volatility and Market Risks

Investing in the stock market involves navigating the uncertainties that come with fluctuating prices and varying market conditions. The J.P. Morgan Equity Premium Income ETF (JEPQ) utilizes a covered call strategy which impacts fund volatility and overall risk management differently than traditional equity investments. This section will explore how the covered call strategy employed by JEPQ influences its volatility, provides risk mitigation, and involves certain limitations under bullish market conditions.

Impact of the Covered Call Strategy on Fund Volatility

Fund Volatility Dynamics:

- Volatility Reduction: The covered call strategy inherently helps in reducing the fund’s volatility. By selling call options on the NASDAQ-100 index stocks, JEPQ collects option premiums, which provide a steady income stream. This income is somewhat independent of the market’s upward or downward movements, which can help to cushion the fund against large fluctuations in asset prices.

- Income Buffer: The premiums received from selling the calls act as a buffer during market dips. When the market declines, for example, the losses in stock values are partially offset by the gains from the option premiums, thus stabilizing the fund’s overall performance.

Historical Volatility Metrics:

- Compared to NASDAQ-100 Index: The NASDAQ-100 is known for its high volatility, especially given its tech-heavy composition which can be sensitive to market sentiment and economic changes. In contrast, by utilizing the covered call strategy, JEPQ typically exhibits lower volatility than the NASDAQ-100, and even the S&P 500 (which we discussed earlier about JEPQ’s beta). This reduced volatility can be beneficial if you’re a risk-averse investor who is seeking steady returns, without additional volatility & risk.

Risk Management

Mitigating Downside Risks:

- Role of Covered Calls: The covered calls serve as a hedge against minor price declines in the underlying stocks. Since the strategy involves selling a call option, the premium received adds to your income and overall return, which can help compensate for any potential decreases in the ETF’s share price.

- Downside Protection: While the protection isn’t absolute, especially in cases of significant market drops, it does provide a cushion that pure stock holdings do not offer.

Limitations in Bullish Market Conditions

Capped Upside Potential:

- Nature of Covered Calls: As we’ve discussed, when implanting a covered call strategy, the maximum profit is capped at the strike price of the sold calls. If the underlying stocks rise above the strike prices of the call options, the additional gains are not realized by the ETF, as the stocks would be called away (assigned) at the strike prices.

- Impact During Bull Markets: Additionally, as we’ve illustrated thus far, in strong bull markets, when the NASDAQ-100 might experience significant gains, JEPQ can underperform relative to the index, due to its gains being capped by the terms of the call options. This limitation is a trade-off, in exchange for the reduced volatility and steady income stream provided by the ETF.

Strategic Considerations:

- Investor Outlook: If you’re considering investing in JEPQ, you should consider having a moderately conservative risk profile, where income and reduced volatility are prioritized over potential high returns during market rallies.

- Portfolio Fit: This ETF is best suited as a component of a diversified portfolio where it can complement higher-risk investments. Specifically, it may be ideal if you are an investor who is seeking income in the form of dividends, along with a more stable principal value.

In summary, the JEPQ ETF provides a strategic approach to investing in the NASDAQ-100 index, by mitigating downside risks through the equity linked notes & covered call strategy. This strategy, however, does introduce a limitation on the maximum possible gains, which can be particularly noticeable in bullish markets.

If you’re an investor seeking to balance income with moderate growth, understanding these dynamics is important to successfully integrate JEPQ effectively into your broader investment strategy. The next sections will dive deeper into the comparative analysis of JEPQ with similar funds, along with discussing potential investment suitability, and the future outlook of the ETF.

Section 4: Comparative Analysis

To determine the value and effectiveness of the J.P. Morgan Equity Premium Income ETF (JEPQ), we can compare it against similar investment vehicles. This analysis will help you understand JEPQ’s relative performance in the landscape of income-generating funds, along with its potential suitability for your investment portfolio(s).

JEPQ vs. Other Income Funds

Comparison with Similar ETFs Using Covered Call Strategies:

- Similar ETFs: ETFs such as the Global X NASDAQ 100 Covered Call ETF (QYLD) and the NEOS Nasdaq-100® High Income ETF (QQQI) also employ covered call strategies on the NASDAQ-100 Index.

- Performance Metrics: While all these ETFs aim to generate income through call premiums, JEPQ distinguishes itself in how the call options are managed. JEPQ tends to write calls over a proportion (generally around 50%) of the portfolio’s value, potentially offering a better balance between income generation and capital appreciation than ETFs such as QYLD, which might cover 100% of the portfolio, thus capping all potential upside.

- Performance Comparison: While JEPQ is up 15.94% over the last year as of writing this, and participating in some of the upside of the NASDAQ-100 index, QQQI is actually down, and QYLD is up only 1.33%.

Benchmarking Against Traditional Dividend Funds and Other NASDAQ-100 Based ETFs:

- Traditional Dividend Funds: When compared to traditional dividend funds, which might focus on sectors known for high dividend yields such as utilities or real estate, JEPQ offers the advantage of exposure to the high-growth potential of the NASDAQ-100’s tech-heavy lineup.

- Other NASDAQ-100 ETFs: Unlike pure index ETFs such as the Invesco QQQ Trust (QQQ), which strictly track the performance of the NASDAQ-100 without an income enhancement strategy, JEPQ provides an additional income stream through its covered call strategy. This can be particularly appealing in stagnant or slightly bearish market conditions, where growth may not be sufficient to meet income needs.

Advantages of JEPQ

Unique Benefits Provided by JEPQ’s Strategy:

- Enhanced Income: The primary benefit of JEPQ’s covered call strategy is its ability to enhance income through the collection of premiums on written call options, which can provide a higher yield compared to dividends alone.

- Partial Downside Protection: The income from the option premiums can offer partial protection against declines in the NASDAQ-100 index, making it a safer bet during market dips than its non-income-focused counterparts.

- Flexibility in Execution: JEPQ’s strategy allows for the selective writing of calls, which can be adjusted based on market volatility and other conditions. This flexible approach helps optimize income generation while allowing for growth in capital.

Conclusion

In conclusion, JEPQ stands out among both traditional dividend-focused funds and other covered call ETFs due to its strategic approach to option writing and the balance it offers between income generation and capital appreciation potential.

Its strategy makes it particularly appropriate if you’re an investor who are cautious yet looking for growth, providing a sophisticated tool to enhance portfolio yields while maintaining a foothold in some of the most dynamic sectors of the market. This comparative analysis underscores JEPQ’s adaptability and potential value-add to a diverse range of investment portfolios.

Section 5: Investment Suitability

Determining whether the J.P. Morgan Equity Premium Income ETF (JEPQ) is a suitable investment for you, depends upon understanding if you can benefit from its unique characteristics and how it can be integrated into your portfolio(s). This section will explore the ideal investor profile for JEPQ, discuss its strategic fit, and provide guidance on portfolio integration.

Suitability for Different Types of Investors:

- Retirees: If you’re a retiree, the consistent income from JEPQ may be ideal for meeting regular expense needs, making it a solid choice if you’re an income-focused portfolios.

- Conservative Investors: If you’re an investor with a fairly conservative risk profile who still desires exposure to a growth-oriented index such as the NASDAQ-100, you might find JEPQ’s covered call strategy attractive for its potential to reduce volatility, and enhance returns through option premiums.

- Income Seekers with Growth Appetite: JEPQ may also be suitable if you’re an investor who is seeking a blend of income and growth. The underlying NASDAQ-100 exposure allows for participation in the upside potential of major tech companies, while the covered call strategy provides ongoing income.

Who Should Invest in JEPQ?

While we discussed potential suitability above, now let’s get into, more specifically, “an ideal investor profile for JEPQ” and what that might look like.

Ideal Investor Profile for JEPQ:

1. Income-Focused Investors:

- Profile Description: If you’re an investor who prioritize steady income generation from their investments, particularly if you’re in retirement or nearing retirement, and are seeking regular cash flows to fund your living expenses.

- Benefits of JEPQ: Provides monthly income through dividends derived from option premiums, which is often higher than traditional dividend-paying stocks or bonds.

2. Risk-Averse Growth Seekers:

- Profile Description: If you’re an investor who is seeking exposure to the growth potential of the NASDAQ-100 index but are cautious about the inherent volatility in tech-heavy indices.

- Benefits of JEPQ: The covered call strategy caps upside potential but significantly reduces volatility and provides downside protection, making it suitable for conservative investors desiring some growth exposure.

3. Diversification Seekers:

- Profile Description: If you are an individual who is aiming to diversify your portfolio(s) with an investment vehicle which combines features of both equity and income funds.

- Benefits of JEPQ: Adds diversification through a non-traditional equity income approach, blending the growth traits of NASDAQ-100 companies with the defensive characteristics of an income-generating strategy.

Strategic Fit into Diversified Investment Portfolios

Integrating JEPQ for Optimal Diversification:

Complement to Traditional Equity Holdings:

- Strategy: You can use JEPQ to complement your existing equity investments that provide high growth but little or no income, such as index funds or individual tech stocks.

- Purpose: JEPQ’s income generation capabilities can help to stabilize portfolio returns during market downturns, providing a hedge against the volatility of pure growth stocks.

Balance to Fixed-Income Instruments:

- Strategy: JEPQ is a beneficial addition if you’re an investor with heavy allocations in bonds or other fixed-income instruments.

- Purpose: It can enhance the yield of your portfolio without significantly increasing risk, offering a better return profile in low-interest-rate environments.

Portfolio Integration

Recommendations on Integrating JEPQ into Existing Portfolios:

1. Percentage Allocation:

- For balanced portfolios, allocating 10-20% to JEPQ may provide sufficient exposure to its benefits.

- Conservative portfolios might increase this allocation, especially if monthly income is a priority.

2. Positioning with Respect to Other Holdings:

- Consider placing JEPQ alongside growth-oriented assets such as tech stocks or sector ETFs, to balance potential high returns with JEPQ’s steady income.

- Use JEPQ as a counterbalance to high-volatility investments, utilizing its call premiums to offset periods of low returns elsewhere in the portfolio.

3. Synergies with Other Investment Vehicles:

With Mutual Funds and Stocks:

- Mutual funds focusing on capital appreciation can be complemented by JEPQ’s income high income features, especially in sectors other than technology, such as consumer discretionary or industrial sectors.

- A synergy occurs when JEPQ’s covered call income can smooth out the volatility typically associated with pure stock holdings.

With bonds:

- In a low-yield environment, JEPQ can significantly enhance the overall yield of a bond-heavy portfolio. Its equities base, along with option income can provide a higher income potential than traditional bonds, or bond funds under current market conditions.

Conclusion

JEPQ is particularly suited if you’re an investor who wants to enjoy the growth potential of NASDAQ-100 companies, while mitigating risk through a covered call strategy. Its role in a diversified portfolio is to provide a balanced approach to income and growth, making it an excellent choice for retirees, conservative investors, or anyone looking to enhance their income without proportionally increasing their risk exposure. Integrating JEPQ effectively requires considering one’s income needs, risk tolerance, and existing portfolio composition to make the most out of its unique investment strategy.

Section 6: Future Outlook and Projections

Understanding the potential future trajectory of the J.P. Morgan Equity Premium Income ETF (JEPQ) and its underlying index can be helpful for trying to determine its strategic positioning and potential performance in the coming years. This section discusses market forecasts for the NASDAQ-100, trends in income-generating strategies, and possible evolutions in JEPQ’s approach.

Market Forecasts

Expert Predictions on the NASDAQ-100’s Performance:

1. Growth Potential:

- The NASDAQ-100, known for its heavy technology sector weighting, is expected to continue its growth trajectory, driven by innovation and the expanding digital economy. However, investors should also be aware of the volatility associated with tech stocks, which can be influenced by regulatory changes, market cycles, and shifts in consumer behavior.

2. Volatility Insights:

- While the long-term outlook remains robust, short-term fluctuations are likely due to external economic factors, including interest rate changes, geopolitical tensions, and other macroeconomic factors. Such volatility can present both risks and opportunities for an ETF employing a covered call strategy.

Expected Trends in Income-Generating Investment Strategies:

1. Increasing Popularity:

- In the current lower-for-longer interest rate environment, income-generating strategies like those used by JEPQ are gaining popularity among investors seeking yield, particularly as traditional bonds and other fixed income investments offer lower returns.

2. Technological Integration:

- The use of technology in managing portfolios, especially strategies involving options, is likely to increase. This can lead to more efficient management of the mechanisms behind covered call strategies, potentially enhancing yield generation.

Evolving Strategies

Potential Changes in JEPQ’s Strategy Based on Market Evolution:

1. Adaptation to Market Conditions:

- JEPQ may adjust the proportion of the portfolio covered by calls or the strike prices of those calls based on prevailing market conditions. For instance, if the market is expected to be bullish, reducing the coverage ratio could allow the ETF to capture more upside.

2. Enhanced Risk Management Techniques:

- Incorporating more sophisticated risk management algorithms that can better predict downturns might allow JEPQ to adjust its covered call layers dynamically, potentially reducing downside risk during market corrections.

Forecast on How Adjustments Might Affect Investor Returns:

1. Modifying Coverage Ratios:

- Changes in the coverage ratio of calls can directly affect the income level and capital appreciation potential. Less coverage generally means higher potential capital gains but reduced income from call premiums.

2. Strike Price Adjustments:

- Altering strike prices or the type of options (e.g., moving from at-the-money to out-of-the-money) could increase the income in return for higher exposure to capital appreciation, appealing to different investor appetites for risk and reward.

3. Long-term Projections:

- Over the long term, if these strategies are managed effectively, JEPQ could potentially offer a higher total return by balancing income generation with capital appreciation, particularly appealing in a market environment where direct equity investments might be considered riskier.

Conclusion

The future outlook for JEPQ looks promising, with the potential for adaptation strategies that could fine-tune its balance between risk and return. As market conditions evolve, particularly with fluctuations in the NASDAQ-100, JEPQ’s covered call strategy will be crucial in navigating these waters, potentially offering investors a safer, income-generating avenue to equity investment. Investors should continue to monitor economic indicators and expert forecasts to align their expectations with the market realities as they unfold.

Summary of Key Points

The J.P. Morgan Equity Premium Income ETF (JEPQ) stands out as an innovative investment vehicle that merges the growth potential of the NASDAQ-100 companies with a conservative income-generation approach through covered calls. This unique combination allows investors to benefit from the possible appreciation of tech-heavy stocks while mitigating risk and generating steady income.

Primary Advantages of JEPQ:

- Income Generation: Utilizes a covered call strategy to provide investors with a consistent income stream derived from option premiums, which is particularly attractive in low-interest-rate environments.

- Risk Mitigation: The covered call strategy also offers a buffer against market downturns, as the option premiums can offset some of the losses that might occur when stock prices fall.

- Growth Potential: By maintaining exposure to the NASDAQ-100 Index, JEPQ allows investors to participate in the potential upside of some of the largest and most innovative companies in the U.S.

Key Considerations:

- Capped Upside: Since the call options are sold as part of the income strategy, there is a cap on the maximum profit that JEPQ can achieve during market rallies.

- Volatility: While generally less volatile than the NASDAQ-100 Index due to the income received from option premiums, JEPQ can still experience fluctuations, particularly influenced by the tech sector’s performance.

- Expense Ratio: With a moderate expense ratio of 0.35%, JEPQ is relatively cost-efficient for a fund that employs a specialized strategy such as covered calls.

Final Recommendations

Based upon the findings discussed throughout this article, the following advice can guide potential investors:

1. Assess Compatibility:

- Investors should evaluate how JEPQ fits within your broader investment portfolio, considering their risk tolerance, income needs, and investment duration.

2. Diversification:

- JEPQ can serve as a valuable component of a diversified portfolio, particularly for those looking to enhance yield without disproportionately increasing risk.

3. Monitor and Adjust:

- Regular monitoring and potentially rebalancing of holdings in JEPQ can help maintain alignment with investment goals, especially given the ETF’s strategy might perform differently across various market conditions.

Call to Action

- Further Research: You are encouraged to dive deeper into JEPQ’s performance history, covered call strategy specifics, and how it compares to other income-generating investment options.

- Consult a Financial Advisor: Before making investment decisions, consider consulting with a financial advisor can provide personalized insights and recommendations, ensuring that any investment in JEPQ aligns with your financial objectives and circumstances.

- Educational Resources: Consider exploring additional resources such as financial webinars, seminars, and publications that provide further analysis on covered call strategies and ETF investments.

By carefully considering JEPQ within the context of these recommendations and your individual investment strategies, you can effectively leverage this ETF to enhance your portfolio’s income potential, while managing risk exposure. The blend of technology growth exposure and premium income through covered calls makes JEPQ a distinctive and potentially valuable addition to an investment portfolio.