Introduction

Overview of VIG:

The Vanguard Dividend Appreciation ETF (VIG) stands out on Wall Street as a potential solution for investors who are seeking sustainable income growth.

The VIG ETF is designed to track the performance of companies that are not only leaders in their industries, but additionally have a consistent track record of increasing their dividends over time. By focusing on such companies, VIG offers investors exposure to firms that are likely well-managed, financially healthy, and committed to returning value to shareholders.

Purpose of the Article:

In today’s analysis, we will dive into the Vanguard Dividend Appreciation ETF’s core investment strategy, providing a thorough examination of both its historical performance, and portfolio composition.

Additionally, we will assess the ETF’s role within a diversified investment portfolio and its potential suitability depending upon your investor profile, whether it be more conservative, or growth-oriented.

Relevance to You as an Investor:

The appeal of dividend growth ETFs such as VIG has been popularized by a niche set of investors in recent years, particularly those focused on both the potential for capital appreciation, and additionally to provide a growing income stream over the long-term. If this sounds like you, keep reading!

Dividend growth can be a sign of corporate health and resilience, which can be attributes particularly particularly desirable during economic downturns. Thus, VIG may serve as an a component of investors portfolios who are seeking a combination of both growth & income over the long-term.

Section 1: ETF Overview

Fund Basics

The Vanguard Dividend Appreciation ETF (VIG) is a prominent offering from Vanguard, one of the largest and most trusted names in investment management. Here are the fundamental details of the fund:

- Ticker: VIG

- Inception Date: April 21, 2006

- Issuer: Vanguard

Investment Strategy

Index Tracked:

VIG is focused on replicating the performance of the NASDAQ U.S. Dividend Achievers Select Index. This index is known for its focus on U.S. companies that not only pay dividends, but also have a history of increasing them annually for at least ten consecutive years.

Selection Criteria:

The key criteria for inclusion in the index is a consistent record of dividend growth. This criteria is essential, since it often indicates companies with superior financial health and a commitment to returning value to shareholders. The focus is not merely on high dividend yield but on the potential for continued growth in payouts, which can provide an inflation hedge and contribute to total return.

Investment Approach:

VIG’s strategy emphasizes dividend growth over high current yield. This approach appeals particularly to long-term investors who value stability and gradual appreciation in their investment value, alongside a slowly increasing income stream. By prioritizing companies that have proven their ability to grow dividends, VIG minimizes exposure to firms that offer high yields without sustainable financial practices.

Conclusion of Section 1

The Vanguard Dividend Appreciation ETF (VIG) offers an appealing option, especially if you are an investor who may be focused on long-term capital growth, accompanied by a progressive dividend income.

VIG’s adherence to a strategy that selects companies with a consistent history of dividend growth ensures that the fund is composed of financially sound companies, with a shareholder-friendly outlook.

This strategic composition makes VIG a suitable choice if you are looking to build wealth steadily, while additionally mitigating the risks associated with chasing high yields in potentially less stable or lower quality stocks.

In the next sections, we will dive into VIG’s historical performance, portfolio composition, and its role in terms of a diversified investment strategy.

Section 2: Analyzing Dividend Performance

Dividend Growth

Historical Growth Rates:

VIG’s focus on companies that have consistently increased their dividends for at least ten consecutive years offers a clear insight into its dividend performance. Historically, VIG’s holdings have demonstrated a steady growth in dividend payouts, outpacing the average growth rates seen in the broader market. This consistent increase not only signals financial robustness, but additionally shareholder-friendly management practices.

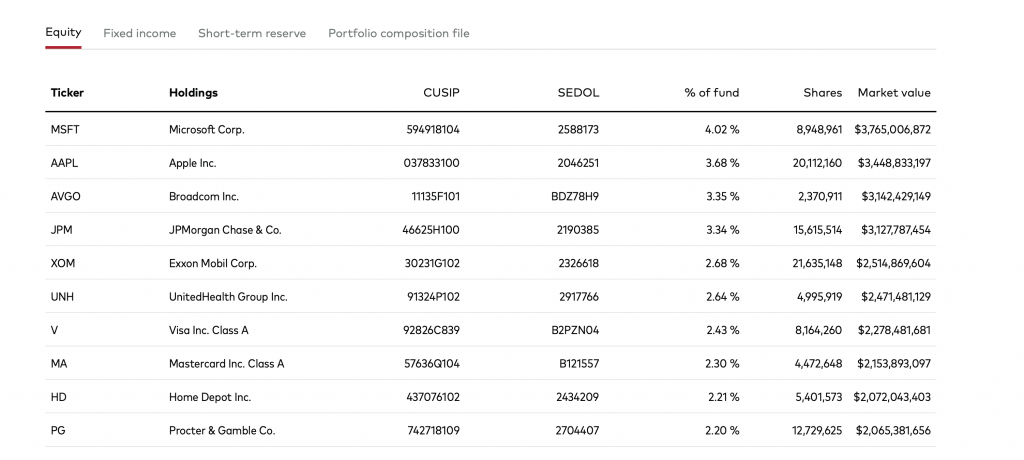

- Comparison with Broader Market: While the broader market may offer higher initial yields, VIG’s portfolio of dividend growers typically provides more sustainable and reliable long-term growth in income, which is important during economic fluctuations and inflationary periods. Below, see some of the holdings for the ETF, courtesy of Vanguard:

Benefits of Dividend Growth Investing:

Investing in entities that regularly increase dividends offers several advantages:

- Compounding Returns: Dividend growth investing contributes to compounding returns as reinvested dividends purchase more shares, which in turn will generate their own dividends, leading to potentially exponential growth of the investment’s value over time.

- Inflation Protection: Regularly increasing dividends can help offset the effects of inflation, preserving the purchasing power of an investor’s income. This is particularly valuable during periods of high inflation when fixed income returns might lose real value.

Yield Analysis

Dividend Yield Overview:

VIG typically offers a current yield of between 1.6% to 2%. This yield range is considered moderate when compared to other dividend-focused ETFs that might target higher-yielding stocks.

- Comparison to Other ETFs: While some dividend ETFs may offer higher current yields, they often do so at the risk of lower dividend growth and potential dividend cuts. VIG’s yield strategy focuses on the long-term growth of payouts, which can be more sustainable.

Yield vs. Growth Trade-offs:

Although you may face a trade-off between moderate current yields, you stand to benefit from the potential for higher future gains, through the reinvestment of growing dividends over the long-term.

- Moderate Current Yields: The relatively lower yield reflects VIG’s strategic choice to focus on companies likely to increase their dividends, rather than those with the highest current yield. This approach reduces risk, focusing on the overall quality of the companies in the portfolio, and aligns with a long-term investment perspective.

- Higher Potential Future Gains: The emphasis on dividend growth over high initial yield aims to provide you with increasing income streams over time. This strategy can lead to significant capital appreciation as the reinvested dividends grow.

Conclusion of Section 2

The Vanguard Dividend Appreciation ETF (VIG) offers a compelling case if you consider yourself an investor who is focused on both long-term wealth accumulation through the power of growing dividends.

By prioritizing dividend growth over high initial yields, VIG may align well with your investment goals if you are seeking steady, reliable, and increasing income over time. This approach, although offering moderate current yields, sets the stage for potentially higher future gains, making VIG an attractive option if you are planning for long-term financial goals such as retirement.

In the next sections, we will dive deeper into VIG’s portfolio composition, market positioning, and suitability for various investor profiles.

Section 3: Performance Metrics

Historical Performance

Long-Term Returns:

VIG’s track record over the past decade showcases its strength as a solid long-term investment.

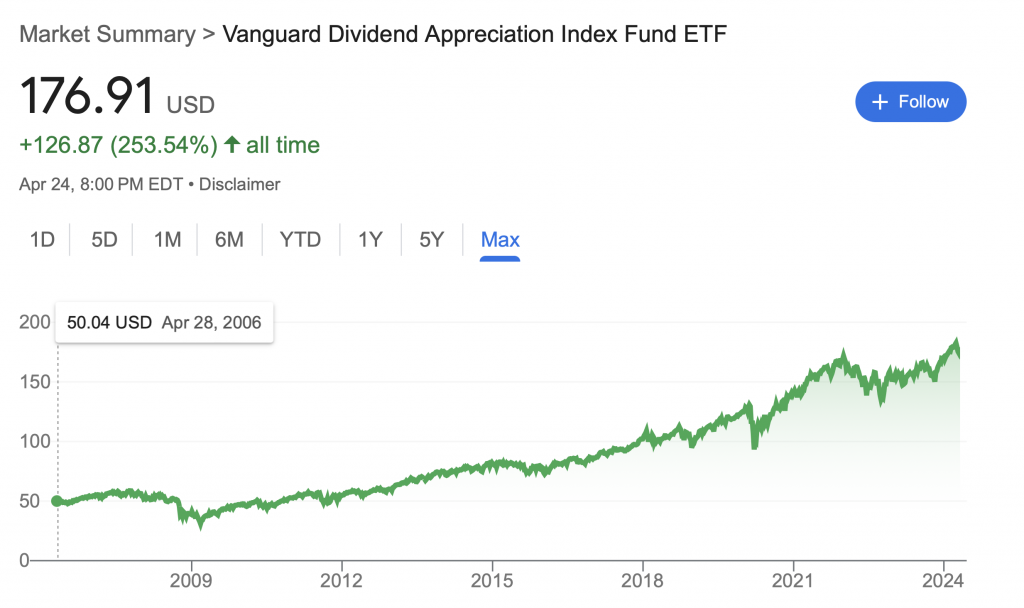

- Total Return Figures: Since inception and not including dividends, VIG has returned over 250%, as illustrated by the chart provided by Google below:

- Last 5 Years: Over the last 5 years and not including dividends, as illustrated by the chart below, investors are still looking at over a 50% appreciation in terms of the share price:

Volatility and Risk:

VIG’s emphasis on dividend growth stocks, which are often less volatile than the broader market, contributes to its appeal as a relatively safe investment option.

- Price Volatility: The stocks within VIG’s portfolio are usually less sensitive to short-term market fluctuations, leading to lower volatility. This is additionally reflected in VIG’s beta, which currently stands at .85, indicating that it is less volatile than the overall market (or S&P 500 benchmark).

- Comparison to Similar Products: When compared to other dividend or growth ETFs, VIG may exhibit lower volatility, making it a potentially suitable option if you are more of a risk-averse investor.

Expense Ratio

Cost Efficiency:

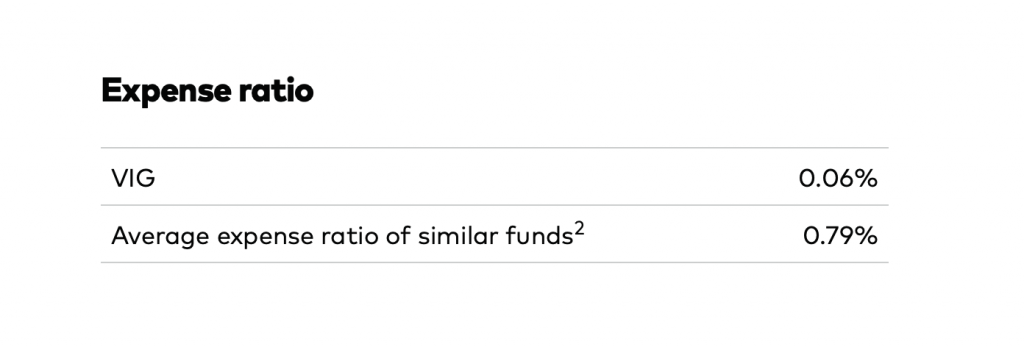

One of VIG’s most compelling attributes is its cost efficiency. With an expense ratio of just 0.06%, it stands out as one of the most economical ETFs in its category.

- Enhancing Investor Returns: The low expense ratio ensures that a larger portion of the investment returns are passed on to the investors rather than being consumed by management fees. This is particularly important in a dividend-focused ETF, where even small percentage points can significantly affect long-term compounding.

- Comparison with Industry Averages: The average expense ratio for similar dividend-focused ETFs can range significantly higher. VIG’s lower costs not only make it an attractive option, but additionally highlight Vanguard’s commitment to providing high-value, low-cost investment solutions.

Conclusion of Section 3

VIG’s combination of strong historical performance, low volatility, and exceptional cost efficiency makes it a standout option within the dividend growth ETF market. Its proven track record of providing competitive total returns, coupled with a conservative approach to stock selection, ensures that it remains a potential choice for those investors who are aiming for long-term capital growth and income stability.

As you continue to navigate through various market conditions, VIG’s characteristics underscore its potential suitability as a component in a diversified investment portfolio, particularly if you have a conservative risk profile, and a focus on steady income growth.

Section 4: Comparative Analysis

VIG vs. Other Dividend ETFs

Similar ETFs:

To contextualize VIG’s performance, it’s worth comparing it with other notable dividend growth ETFs. These ETFs are also geared towards investors who prioritize dividend income, but their strategies may differ significantly.

- ProShares S&P 500 Dividend Aristocrats (NOBL): NOBL specifically targets companies within the S&P 500 that have increased dividends every year for at least 25 consecutive years, emphasizing traditional blue-chip stability.

- High Dividend ETFs: Other ETFs in this category might focus on achieving the highest possible current yield, often by including companies with higher payout ratios or those in sectors like utilities and real estate.

Performance Comparison:

When benchmarking VIG against these ETFs, several dimensions should be considered:

- Yield: VIG typically offers a moderate yield focused on growth potential rather than the highest current yield. In contrast, high dividend ETFs might offer higher yields but with potentially greater risk and volatility.

- Performance: VIG’s emphasis on dividend growth often translates into superior long-term total returns, since the compounding effect of growing payouts adds significant value over time.

- Expense Ratio: VIG’s low expense ratio of 0.06% is generally lower than many comparable ETFs, making it more cost-effective and thus increasing net investor returns relative to more expensive ETFs.

Market Positioning

Unique Selling Points:

VIG distinguishes itself in the crowded ETF marketplace with several key attributes:

- Focus on Dividend Growth: Unlike ETFs that chase high current yields, VIG targets companies likely to increase their dividends. This strategy tends to attract investors who are more risk-averse and interested in sustainable income growth.

- Low Fees: VIG’s competitive fee structure is a significant advantage, reducing the drag on returns and making it attractive for cost-conscious investors.

- Stable Issuers: The companies included in VIG’s portfolio are typically financially healthy, with a track record of steady performance and resilience in various market conditions.

Risk/Reward Profile:

VIG’s strategic emphasis on companies with growing dividends presents a distinctive risk/reward profile:

- Lower Risk: By focusing on companies that have a consistent record of dividend growth, VIG inherently selects for entities with stable earnings and strong financial fundamentals, which can reduce investment risk.

- Long-Term Investor Appeal: The lower volatility and potential for steady capital appreciation combined with dividend growth make VIG particularly appealing if you are a long-term investor, including retirees or those in wealth accumulation phases who value both income and growth.

Conclusion of Section 4

VIG stands out among dividend-focused ETFs, due to its balanced approach to income and growth, stringent selection criteria for dividends, and low-cost structure. These factors make VIG a prudent choice if you are an investor seeking a blend of safety, steady income growth, and long-term principal growth.

Compared to other dividend ETFs which may focus more on high current yields, VIG’s strategy offers a compelling alternative if you are looking to minimize risk & volatility, while enjoying the benefits of dividend compounding.

Section 5: Portfolio Considerations

Investor Suitability

Who Should Invest:

VIG is particularly well-suited for long-term investors who prioritize reliable income growth alongside capital appreciation. Its strategic focus on dividend-growing companies makes it an excellent choice for those preparing for significant future expenses, such as retirement.

- Long-Term Investors: If you have a longer term investment horizon, you may benefit from VIG’s focus on companies which are likely to increase dividends over time, which can help grow your portfolio steadily, and provide increasing income.

- Retirement Planning: If you are nearing or in retirement, you may find VIG appealing due to its potential to offer a steady and potentially increasing income stream, essential for funding retirement living expenses, without eroding principal.

Strategic Portfolio Role:

VIG can serve as a core equity holding in a diversified portfolio:

- Risk-Profile and Growth Orientation: VIG’s moderate risk profile and focus on stable, dividend-growing companies make it a solid foundation for any investment portfolio, balancing out more volatile investments.

Portfolio Integration

Diversification Benefits:

Including VIG in a diversified portfolio can provide several benefits:

- Complements Fixed-Income Assets: VIG’s equities may offer the potential for higher returns compared to fixed-income assets, while still providing stability through dividends, which can be particularly advantageous in lower interest-rate environments.

- Balances High-Volatility Equities: For portfolios heavy on high-volatility equities, including sectors like technology or biotech, VIG can provide a stabilizing counterbalance, reducing overall portfolio volatility, without significantly diluting potential returns.

Allocation Strategies:

Suggested portfolio allocations for VIG vary based on individual investor risk profiles and financial goals:

- Conservative Portfolios: If you are more of a conservative investor, VIG could perhaps comprise up to 20-30% of the equity portion, providing a stable income and growth with lower volatility.

- Aggressive Portfolios: In more aggressive portfolios, VIG might represent a smaller portion, around 10-15%, serving as a risk mitigator and a source of steady dividends.

Conclusion

Recap of VIG’s Advantages:

VIG stands out for its strategic focus on dividend growth, operational stability, and cost efficiency. These characteristics may make it an attractive option if you are seeking dependable growth, along with income from your investments.

Final Recommendations:

- Retirees and Pre-Retirees: VIG may be ideal if you are an investor who is either in or approaching retirement, since it provides a growing income stream that can help maintain purchasing power in inflationary periods.

- Long-Term, Growth-Focused Investors: If you have a longer time horizon, VIG may offer a solution to steadily accumulating wealth, while while mitigating some of the risks typically associated with equities.

Call to Action:

You are encouraged to consider how VIG might complement and enhance your existing investment strategies. Given its unique characteristics, VIG could potentially play a significant role in helping you achieving diversified, balanced, and growth-oriented investment portfolio.

Additionally, consulting with a financial advisor or other investment professional, can help tailor VIG’s integration into your personal investment plans, ensuring it aligns with your individual financial goals and risk tolerance. This proactive approach will help to maximize the benefits VIG may offer as part of a comprehensive investment strategy.

Portfolio Integration

Diversification Benefits

VIG complements other investments within a diversified portfolio effectively, especially when paired with fixed-income assets and high-volatility equities:

- With Fixed-Income Assets: VIG offers a higher potential for growth compared to traditional fixed-income investments, making it a potential supplement to increase a portfolio’s yield, while maintaining a relatively stable risk profile.

- With High-Volatility Equities: The stable and predictable nature of dividend growth stocks within VIG can help balance your portfolio, especially if you are heavily invested in high-volatility sectors such as technology or biotech, thus reducing your overall portfolio risk.

Allocation Strategies

The allocation to VIG should be tailored according to your risk tolerance, investment horizon, and financial objectives:

- Conservative Portfolios: If you are an investor who is seeking stability and income, VIG could comprise 20-30% of the equity segment of the portfolio, providing steady income and reducing overall volatility.

- Aggressive Portfolios: If you consider yourself to have a higher risk tolerance and a longer term investment horizon, a 10-15% allocation might be appropriate, where VIG could perhaps provide a stabilizing effect without significantly diluting the growth potential from more volatile investments.

Conclusion

Recap of VIG’s Advantages

VIG stands out due to its focus on companies that consistently grow their dividends, which can be indicative of their financial health and management commitment to shareholder returns. The ETF’s low expense ratio additionally enhances net returns, making it an attractive option for cost-conscious investors. Furthermore, the stable performance of VIG makes it a reliable cornerstone for any diversified investment portfolio.

Final Recommendations

- For Retirees: VIG may be particularly suitable if you are a retiree seeking a reliable and growing income stream, in order to support retirement expenses, along with combining income generation with capital preservation.

- For Long-Term Growth-Focused Investors: If you are a younger investor or focused with a longer term time horizon, you may benefit from the compounding effect of reinvested dividends and potential capital appreciation offered by VIG.

Call to Action

You should consider how VIG may fit into your broader long-term investment goals, particularly its role in providing growth and stability. Consulting with a financial advisor can help tailor this integration, ensuring that VIG’s inclusion aligns with your personal financial goals, risk tolerance, and investment horizon.